Owning a home in Babcock Ranch, Florida, comes with many benefits, but staying informed about ongoing costs like property taxes is essential. These annual fees fund critical local services like schools, fire departments, and infrastructure. Unlike a mortgage, your tax bill may fluctuate as your home’s market value changes, making it vital to grasp how calculations work.

Local governments determine tax rates based on an assessed value, which often differs from a home’s sale price. For example, Florida uses an assessment ratio to calculate taxable amounts, while exemptions can lower your final obligation. This guide simplifies the process for Babcock Ranch residents, using real-world scenarios to clarify complex terms like millage rates and comparable sales data.

Whether you’re a first-time buyer or a seasoned investor, knowing how local tax exemptions apply ensures no surprises. The team at Babcock Ranch Homes is here to help—call 518-569-7173 for personalized support tailored to your property’s unique location and value.

Key Takeaways

- Property taxes fund community services and depend on your home’s assessed value.

- Market value and assessed value differ, impacting your final tax amount.

- Florida’s assessment ratio and exemptions can reduce taxable obligations.

- Local millage rates vary by county and city, affecting annual bills.

- Babcock Ranch Homes offers specialized guidance for navigating local tax rules.

Understanding Property Tax Components

Two factors shape your annual obligations: valuation methods and local tax policies. Let’s explore how these elements interact in Babcock Ranch.

Market Value vs Assessed Value

Market value reflects what buyers might pay based on recent comparable sales. For example, if similar 3-bedroom homes sold for $300,000 nearby, that becomes your baseline. Assessors then apply Florida’s 85% assessment ratio to determine taxable value.

| Factor | Market Value | Assessed Value |

|---|---|---|

| Source | Recent sales data | County calculations |

| Example | $300,000 sale price | $255,000 taxable amount |

Millage Rates & Savings Opportunities

Local governments set millage rates – $1 per $1,000 of assessed value. A home valued at $255,000 with a 15-mill rate would owe $3,825 annually before exemptions.

“Homestead exemptions can reduce taxable value by up to $50,000 for primary residences.”

- Senior citizen discounts

- Veteran benefits

- Energy efficiency credits

Verify your eligibility through Charlotte County’s assessor portal. Babcock Ranch’s unique location means some exemptions differ from statewide averages.

Key Terms and Definitions in Property Tax

Decoding industry jargon helps homeowners avoid confusion when reviewing obligations. Let’s clarify four essential phrases that directly influence annual payments.

Assessment Ratio and Taxable Value

The assessment ratio determines what percentage of a home’s market price becomes its taxable base. Florida uses an 85% ratio, meaning a $300,000 residence has a $255,000 assessed value. Tax authorities then apply local rates to this adjusted figure.

| Term | Role | Example |

|---|---|---|

| Taxable Value | Final amount used for calculations | $255,000 after exemptions |

| Market Value | Baseline from recent sales | $300,000 purchase price |

Understanding Exemptions and Credits

Reductions like Homestead exemptions lower your taxable value before rates apply. A primary residence could subtract $50,000, turning a $255,000 assessment into $205,000. Other opportunities include:

- Senior citizen discounts (age 65+)

- Military service benefits

- Solar panel installation rebates

“Misunderstanding exemption deadlines causes many homeowners to overpay. Always verify submission dates with your county.”

These terms form the blueprint for your annual tax bill. Knowing how ratios adjust values and which discounts apply prevents unexpected costs, especially for new buyers navigating Babcock Ranch’s unique regulations.

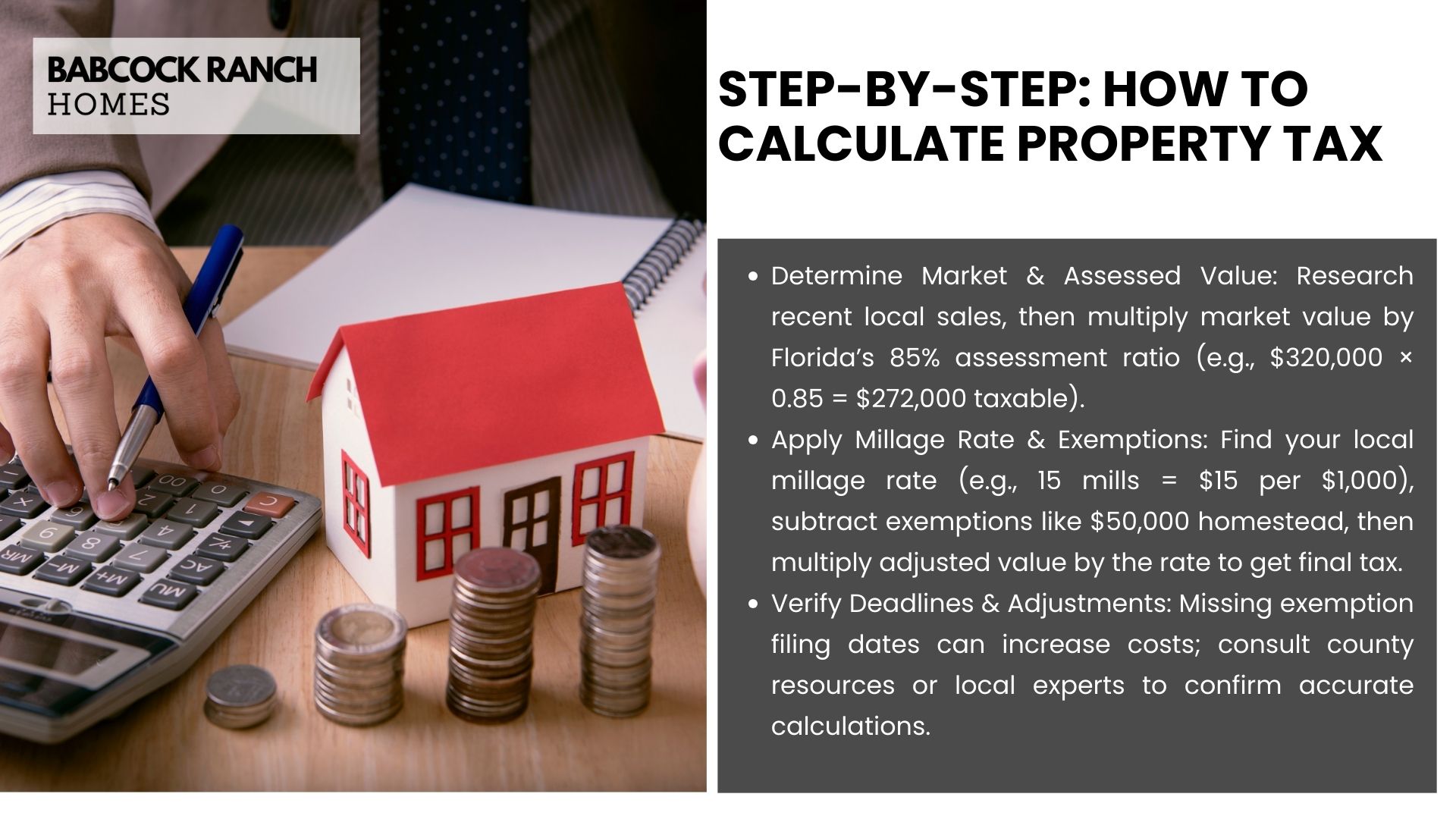

Step-By-Step: How to Calculate Property Tax

Breaking down your annual obligations into manageable steps helps maintain financial clarity. Follow this roadmap to estimate costs accurately while accounting for Florida’s unique regulations.

Determining Your Home’s Market and Assessed Value

Start by researching recent sales of similar homes in your neighborhood. Online portals like Zillow or county records provide this data. For a 3-bedroom residence, compare prices from the last six months to establish a baseline.

- Confirm the current assessment ratio (85% in Florida) via Charlotte County’s assessor portal

- Multiply your estimated market value by this percentage

- Example: $320,000 home × 0.85 = $272,000 taxable base

Applying the Correct Tax Rate and Exemptions

Locate your area’s millage rate through official county communications or the assessor’s office. A 15-mill rate means $15 per $1,000 of adjusted value.

| Step | Calculation | Result |

|---|---|---|

| Base Tax | $272,000 × 0.015 | $4,080 |

| Homestead Exemption | $272,000 – $50,000 | $222,000 |

| Final Obligation | $222,000 × 0.015 | $3,330 |

“Always cross-reference exemption deadlines—missing them by even one day could cost thousands.”

Schedule a consultation with local experts if adjustments seem incorrect. Babcock Ranch’s blend of state policies and community-specific rules often requires tailored verification.

Local Considerations in Babcock Ranch, Florida

Navigating tax obligations in Babcock Ranch requires awareness of regional policies shaping annual payments. While Florida’s statewide rules provide a framework, local adjustments create unique opportunities for homeowners.

Florida-Specific Tax Regulations

Florida’s Homestead Exemption offers primary residents up to $50,000 reduction in assessed value. Unlike other states, this benefit automatically renews annually if ownership remains unchanged. Additional savings include:

- “Save Our Homes” cap limiting annual value increases to 3%

- Senior citizen discounts for those aged 65+ meeting income requirements

- Disabled veteran exemptions removing up to $5,000 from taxable amounts

Babcock Ranch’s location within Charlotte County means millage rates differ from neighboring Lee County. Current rates combine school district levies, municipal fees, and special district assessments.

Contacting the Assessor’s Office for Personalized Information

Charlotte County’s assessor office provides customized reports detailing your home’s tax exemptions and potential adjustments. Key questions to ask:

- Are there pending rate changes affecting next year’s bill?

- What documentation proves eligibility for energy efficiency credits?

- How does recent construction impact my property value assessment?

“Residents often overlook portability rights allowing them to transfer Save Our Homes benefits between Florida properties.”

For tailored guidance, Babcock Ranch Homes offers free consultations at 518-569-7173. Their team clarifies how community infrastructure projects or zoning updates might influence future obligations.

Examples and Practical Calculations

Real-world scenarios clarify how location and regulations shape annual obligations. Let’s examine three cases demonstrating the impact of comparable sales data and state-specific rules.

Using Comparable Sales Data in Calculations

A Chicago home’s market value is determined by recent sales of similar 2-bedroom properties. If neighbors sold for $239,100, this becomes the baseline. Illinois applies a 10% assessment ratio, creating a $23,910 taxable base. With a 2.11% tax rate, the annual obligation totals $5,045.

| State | Market Value | Assessment Ratio | Tax Rate | Annual Payment |

|---|---|---|---|---|

| Illinois | $239,100 | 10% | 2.11% | $5,045 |

| California | $650,000 | 100% | 0.73% | $4,745 |

| Texas | $325,000 | 100% | 1.80% | $5,850 |

Scenario-Based Examples from Different Jurisdictions

California’s full-value assessment contrasts with Texas’s lack of income-based exemptions. A $650,000 Los Angeles home pays $4,745 annually at 0.73%, while a similarly priced Austin residence owes $5,850 due to higher rates.

“Always request your county’s assessment methodology—some states update values annually, others every three years.”

Even minor differences matter. A $50,000 Homestead exemption in Florida reduces obligations by $750 at a 15-mill rate. Online tools from Zillow or Redfin provide preliminary estimates, but local assessors confirm final amounts.

Strategies to Lower Your Property Tax Bill

Smart homeowners know proactive measures often yield the best financial outcomes. By combining careful review processes with local policy knowledge, you can identify opportunities to reduce annual obligations without compromising services.

Review, Appeal, Adjust

Start by scrutinizing your annual statement for errors in square footage or room counts. If neighboring homes with similar features have lower valuations, gather comparable sales data as evidence. Many counties accept online appeals within 30 days of assessment notices.

Key steps for successful challenges:

- Request your property record card for accuracy checks

- Obtain a certified appraisal if disputing value estimates

- Submit photos showing structural issues affecting home worth

“Over 40% of appeals succeed when supported by three comparable properties assessed below market rates.”

Regularly verify active exemptions through county portals. A $25,000 Homestead benefit overlooked for five years could mean $1,875 in overpayments at a 15-mill rate. Schedule biennial reviews with specialists to:

- Evaluate eligibility for new tax exemptions

- Monitor proposed local tax rate changes

- Adjust strategies based on zoning updates

Professional advisors often spot savings opportunities first-time filers miss. Babcock Ranch Homes provides free assessment audits—call 518-569-7173 to explore customized solutions aligning with Florida’s evolving regulations.

Conclusion

Mastering property tax calculations transforms uncertainty into confidence for Babcock Ranch homeowners. By understanding how market value differs from assessed amounts and leveraging Florida’s exemptions, you gain control over annual obligations. Local factors like Charlotte County’s millage rates and Homestead benefits further refine what you owe.

Regular reviews of assessment notices ensure accuracy, while timely appeals protect against overpayments. This guide serves as your roadmap—from analyzing comparable sales data to applying region-specific discounts. Keep it handy when evaluating tax statements or planning budget adjustments.

For personalized support, connect with Babcock Ranch Homes at 518-569-7173. Their team clarifies complex regulations and identifies savings opportunities tailored to your residence. Knowledge truly becomes power when navigating local tax landscapes—equip yourself wisely.

With these insights, you’re prepared to make informed decisions that protect your investment and community contributions. Smart planning today builds financial stability for tomorrow.