Imagine working together with others to achieve more than you could alone. This is what real estate partnerships offer. At Babcock Ranch Homes, we’ve seen investors in Florida team up to overcome challenges like high upfront costs and complex local markets.

Creating a joint venture is like building a strong relationship. It needs clear roles, shared goals, and trust. Whether it’s for a beachfront condo or a commercial project, working together allows you to use different skills and share risks.

Our team helps clients navigate these shared ownership models. We guide them through various agreements, from silent investors to active management roles. The right structure depends on your financial goals and how much risk you’re willing to take.

Key Takeaways

- Collaborative models enable access to larger investments with reduced personal capital

- Properly structured agreements clarify responsibilities and profit distribution

- Florida’s growing markets benefit from local expertise in partnership deals

- Multiple formats exist, from hands-off investor roles to active development teams

- Legal documentation protects all parties and ensures compliance

What Is a Real Estate Partnership

In Florida’s real estate market, partnerships help investors work together. They share risks, responsibilities, and rewards. This teamwork is key in growing areas like Babcock Ranch.

Together, they can create storm-resilient neighborhoods or commercial areas. This way, individual talents become a team effort towards success.

Legal Framework for Collaborative Investing

Florida’s partnerships usually follow the Real Estate Limited Partnership (RELP) model. This model outlines important rules:

- Liability protection: Limited partners are financially safe, while general partners handle the work

- Regulatory compliance: RELPs help meet environmental codes in places like Babcock Ranch

- Profit distribution: There are clear rules for sharing profits from projects

Partnerships must also plan for hurricanes in coastal areas. This is important for Babcock Ranch’s green projects.

Roles of General vs Limited Partners

Real estate partnerships work best with clear roles:

- General Partners (GPs): They manage day-to-day tasks, get permits, and take on all risks

- Limited Partners (LPs): They invest money in projects and get tax benefits without direct oversight

In Babcock Ranch, GPs deal with contractors and schedules. LPs get tax perks without the construction hassle.

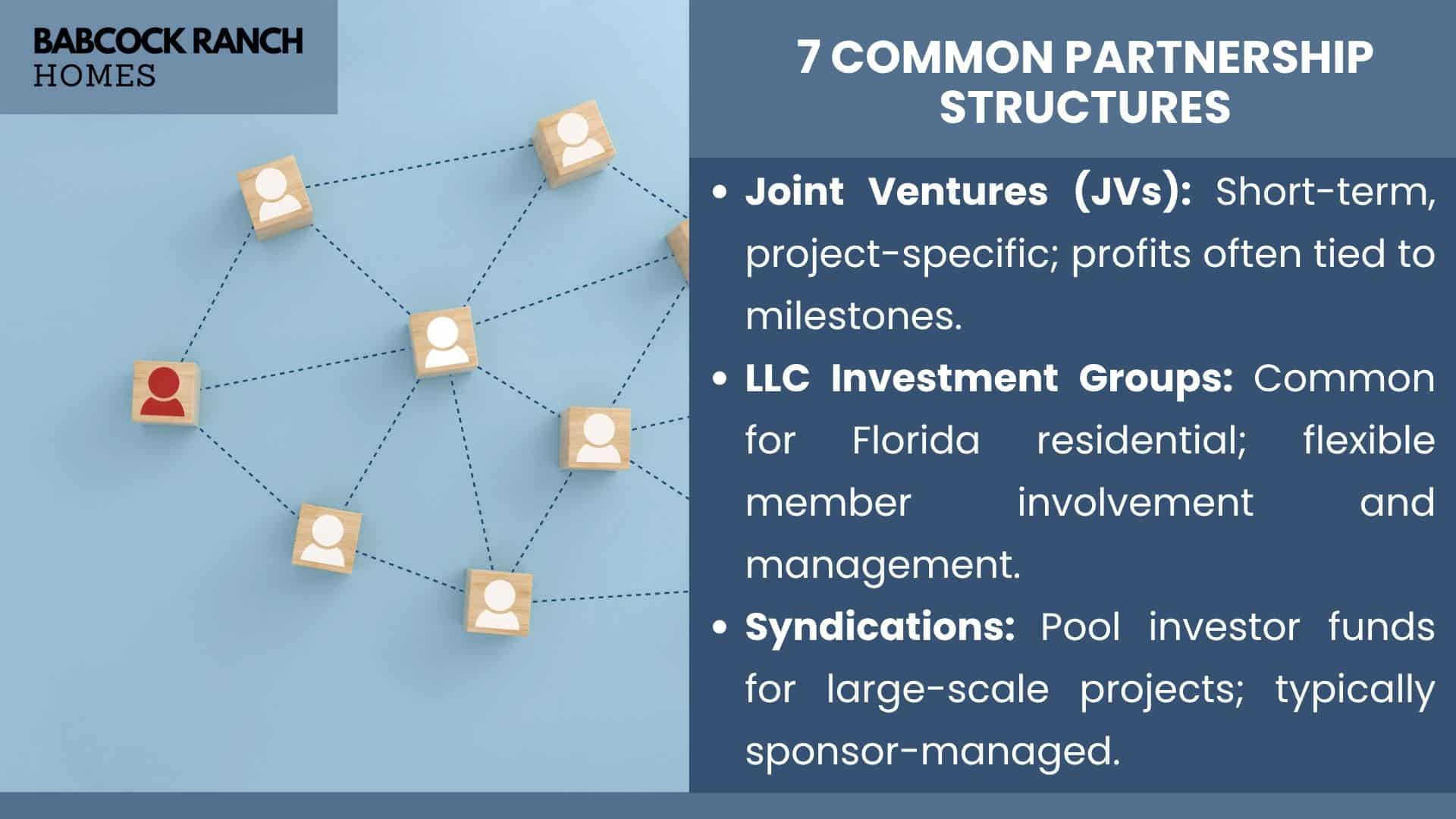

7 Common Partnership Structures Explained

Florida real estate investors have many ways to work together. Each model has its own benefits for different goals. We’ll look at three main types – from short-term alliances to big capital pools – with examples from places like Babcock Ranch.

Joint Ventures for Specific Projects

Short-term partnerships are great for single projects like land development or condo changes. These real estate joint ventures share profits based on project goals.

Timeline-Driven Profit Sharing

Look at how Babcock Ranch developers set up their retail partnerships:

- 25% profit release after infrastructure is done

- 50% distribution when tenants move in

- Last 25% paid after 12 months of steady operations

This method ties payouts to project progress, helping partners as the project grows.

LLC-Based Investment Groups

Limited liability companies are big in Florida’s homes market because they’re easy to manage. Members can pick their level of involvement:

- Active in daily decisions

- Silent partners with profit rights

- Hybrid models with voting and non-voting units

Flexible Management Options

Naples investor groups often use LLCs with different membership levels. A group managing vacation rentals near Marco Island has:

- Full members vote on upgrades

- Associate members okay budget changes

- Passive investors get quarterly reports

Syndication Models for Large Deals

Syndication is good for big projects like commercial properties or big apartment buildings. A Babcock Ranch mixed-use project raised $18M through this real estate partnership structure:

- Sponsor found a 12-acre retail site

- 70 accredited investors funded it

- Preferred returns given quarterly

- Asset sale after 5 years

Syndications are great for big projects needing lots of money and special skills, like building strong against storms or creating smart communities.

Key Benefits for Florida Investors

Florida’s real estate market is booming, giving investors big advantages. By working together, you can use special skills, buy more, and handle tough weather. You can also focus on areas like Babcock Ranch that are growing fast.

Leveraging Local Market Knowledge

To succeed in Florida, you need to know the local markets well. Partnerships help you use the knowledge of agents, contractors, and planners. They know the trends in places like Southwest Florida.

For example, in Babcock Ranch, partners used local data to place retail spaces near new homes. This made the spaces more appealing to tenants.

Pooling Resources for Commercial Properties

Working together makes it easier to buy big properties. By sharing money, investors can get into:

- Mixed-use developments in growing suburbs

- Medical office buildings near retirement communities

- Warehouse spaces along I-75 distribution corridors

This way, you can take on bigger projects without risking too much. It also lets you access properties that usually need a lot of money.

Storm-Resilient Community Investments

Florida’s weather is tough, and solo investors often can’t handle it alone. Partnerships in Babcock Ranch show how working together can make communities safer. They add features like:

- Underground power lines

- Solar-powered community centers

- Elevated building foundations

These upgrades keep property values high and attract buyers who want safe places to live.

Drafting Effective Partnership Agreements

Creating a solid real estate partnership agreement is key. It balances money matters with safety nets. In Florida, where storms and growth meet, these agreements are vital for working together well.

Capital Contribution Requirements

Clear rules on who puts in what money can stop 43% of fights, says the Florida Bar Association. Make sure to:

- Set out initial cash payments and when they’re due

- Value properties for those who contribute them

- Recognize the value of hard work and time invested

Babcock Ranch projects have hurricane mitigation clauses. They ask partners to chip in 2% for storm-proofing.

Preferred Return Structures

In Florida, partnerships often share profits in layers. A common setup is:

- 8% return to those who just invest

- 60/40 split of extra profits between those who work and those who invest

- Money goes out every quarter, with financial reports checked by auditors

Exit Strategy Formulations

Good exit plans cover three main areas:

- Goals for property value growth (like a 20% ROI)

- Best times to sell, avoiding storm seasons

- How to buy out partners who don’t agree

Agreements in Southwest Florida might have a 90-day right-of-first-refusal clause. This keeps local control.

Dispute Resolution Processes

Florida law says try mediation first before going to court. Good agreements should:

- Have a 30-day pause before making decisions

- Choose a mediator based on clear criteria

- Use arbitration for technical disputes

Recent partnerships in Lee County saved $78k on legal costs with these steps.

Tax Advantages in Florida Partnerships

Florida’s tax-friendly policies offer great benefits for real estate investors in partnerships. Investors in places like Babcock Ranch can use state and federal incentives. This helps them earn more while paying less in taxes.

No State Income Tax Benefits

Florida is one of just seven states without personal income tax. This is great for partnerships that pass through income. It means:

- No state tax on income from partnerships

- Full federal tax deductions for business costs

- Easier accounting for LLCs with many members

In Babcock Ranch, this lets partners put more money into green projects. They don’t have to pay as much in taxes.

Cost Segregation Opportunities

The Tax Cuts and Jobs Act (TCJA) made depreciation better with cost segregation studies. Partnerships in commercial properties can:

- Depreciate qualifying assets faster

- Use bonus depreciation up to 100%

- Reduce rental income with quick deductions

Recent projects in Babcock Ranch used these methods. They recovered 30% of costs in just five years.

Opportunity Zone Synergies

Florida has 427 Opportunity Zones, perfect for partnerships. Investors in Babcock Ranch’s areas get:

- Delay in capital gains tax until 2026

- 15% reduction in basis for reinvested gains

- No tax on qualified investments after 10 years

These benefits offer double advantages. They work well with Florida’s tax laws. This is great for long-term projects in the community.

Babcock Ranch Success Stories

Florida’s Babcock Ranch is a model for real estate teamwork. It shows how partnerships can build successful communities and make money for investors. These stories offer lessons in mixing new ideas with practical finance.

Sustainable Community Developments

Babcock Ranch Homes led the way in creating America’s first solar town. A group of five partners worked together. They brought skills in green energy, city planning, and Florida’s environment to make a 17,000-acre town.

This town makes 150% of its daytime energy needs.

Investor Consortium Case Study

The team set up a special partnership for the project. They made three main rules:

- They divided the project into parts based on who was doing what (solar vs homes)

- They shared profits based on how fast homes sold

- They had rules for solving disagreements, based on Source 1’s ideas

This plan helped 3,500 homes sell 22% faster than others. And 98% of residents were happy.

Retail Corridor Partnerships

The Town Center shows how to share risks to draw in different investors. A group worked together to build a mixed-use area. They had big stores like Publix and local shops with special lease deals.

Risk/Reward Allocation Example

Using Source 3’s ideas, they set up:

- They called for money in phases, based on how many homes were occupied

- They gave infrastructure investors a first look at profits

- They offered bonuses for bringing in new tenants

This plan gave investors 19% returns a year, even in tough 2022. It shows how good teamwork can handle Florida’s challenges.

Start Your Partnership Journey Today

Setting up a real estate partnership is easy with the right guide. Florida’s market is full of chances, from commercial deals to green projects. Here’s how to start a partnership that meets your financial goals:

- Define Investment Objectives: Decide if you want quick commercial wins or long-term homes like Babcock Ranch.

- Select Partnership Structure: Pick LLCs, joint ventures, or syndication based on your project and risk level.

- Draft Legal Agreements: Write down how money is shared, profits split, and when to exit, using Florida laws.

Florida offers tax perks, like no state income tax and special zones for investments. Partnerships here can boost local areas and profits, as seen in Babcock Ranch.

Are you ready to invest together? Babcock Ranch Homes can help with partnerships for Florida. Call 518-569-7173 for advice on matching your plan with market trends.

Conclusion

Real estate partnerships unlock Southwest Florida’s full power by sharing skills and resources. Investors get into commercial projects and storm-safe areas. They also enjoy tax benefits that solo efforts can’t match.

These partnerships do more than make money. They help build lasting value in places like Babcock Ranch. This is key for growth.

Clear agreements set out who does what, the risks, and the rewards. Florida’s tax rules help increase profits. Babcock Ranch Homes shows how teamwork leads to lasting development.

From shopping areas to green neighborhoods, partners use their knowledge to meet demand. This is how they succeed together.

Every investor’s journey is unique. But, knowing the local scene is the first step. Look into partnership types that fit your goals in Naples, Fort Myers, or Sarasota.

Working with experts can help you understand what you need. This includes money, how to get out, and local rules.

Babcock Ranch Homes offers real advice on teaming up in real estate. By working together, you can buy more and face risks less. Real estate partnerships are all about turning individual dreams into shared success.