Knowing your returns is key to smart property investment. Return on Investment (ROI) is like a financial compass. It helps buyers and investors make profitable choices. Babcock Ranch Homes, a leader in Southwest Florida, sees ROI as essential for building wealth through real estate.

ROI shows how much profit a property makes compared to its costs. This includes the purchase price, renovation costs, and maintenance. For instance, a vacation rental in Southwest Florida can earn rental income and increase in value. These factors affect its ROI.

New investors often forget about hidden costs like property taxes or insurance. These can greatly change your returns. Babcock Ranch Homes makes these calculations easier. They use local market knowledge and clear data analysis. Their method fits Florida’s growth climate, where location and tourism trends matter a lot.

Key Takeaways

- ROI determines a property’s profitability by comparing gains to total costs

- Accurate calculations require accounting for both upfront and hidden expenses

- Southwest Florida’s market dynamics demand localized ROI analysis

- Seasonal rental patterns significantly influence annual returns

- Professional guidance helps navigate complex valuation factors

Why Real Estate ROI Matters for Investors

Successful investors don’t gamble – they measure. They use return on investment to make smart choices. This is key in markets like Southwest Florida. Let’s see how real estate investment analysis helps you succeed, compare options, and grow wealth.

Understanding Investment Performance Measurement

ROI is your guide in property investing. It shows real profit after costs, tracks performance, and spots bad investments.

- Reveals true profitability after all expenses

- Tracks performance across market cycles

- Identifies underperforming assets quickly

In Babcock Ranch, investors use ROI to spot lasting value. First Source’s research shows it’s a top performer, with 14% average returns from 2020. This beats many Florida areas.

Comparing Different Property Opportunities

Should you invest in a fixer-upper in Punta Gorda or a new home in Babcock Ranch? ROI helps decide:

- Which property makes more cash?

- What growth can you expect?

- How do upkeep costs compare?

New eco-communities like Babcock Ranch have high occupancy rates. They’re at 98% now, beating the 89% average in Southwest Florida.

Long-Term Wealth Building Strategies

Smart ROI choices can build wealth over time. Here are some strategies:

- Reinvesting profits in more properties

- Using tax breaks from depreciation

- Expanding your portfolio with equity growth

Babcock Ranch’s planned community model offers steady value growth. It’s 6.8% a year, more than unplanned areas. This makes ROI predictions more solid for 10 years.

Essential Components of Real Estate ROI

To get a true picture of ROI, you need to know four key areas. These areas help figure out if a property is a good investment or not. Whether it’s a rental in the suburbs or a green community like Babcock Ranch, these factors are critical.

Initial Investment Costs Breakdown

The costs you pay at the start are the foundation of your returns. Important costs include:

- Purchase price and closing costs (usually 2-5% of the property’s value)

- Renovation or upgrade costs (like solar panels in Babcock Ranch homes)

- Financing fees and loan origination charges

In Southwest Florida, buyers often pay 3-8% more than the listed price for energy-efficient homes. These initial costs can lead to savings over time.

Ongoing Operational Expenses

Monthly costs affect your cash flow. Key ongoing payments are:

- Property taxes and insurance (20-35% of annual costs)

- Maintenance and repairs (1% of the property’s value each year)

- HOA fees in planned communities like Babcock Ranch

Solar homes in Babcock Ranch show how green features can cut utility bills. Some owners see their bills drop by 40% compared to regular Florida homes.

Income Generation Factors

Income streams turn properties into profit makers. Important income sources are:

- Rental income (monthly rates minus vacancy periods)

- Ancillary income from storage or parking fees

- Short-term rental income in tourist areas

Babcock Ranch’s community features, like pools and trails, allow owners to charge 12-18% more than average. This shows how amenities can increase earnings.

Property Value Appreciation

Market forces and improvements can quietly build wealth through:

- Neighborhood development (new schools/businesses make areas more desirable)

- Infrastructure upgrades (like better roads and utilities)

- Strategic renovations (kitchen or bath remodels can return 70-80% of the cost)

Southwest Florida’s 14.3% annual appreciation rate in 2023 shows the power of location. Babcock’s planned commercial area suggests continued value growth until 2030.

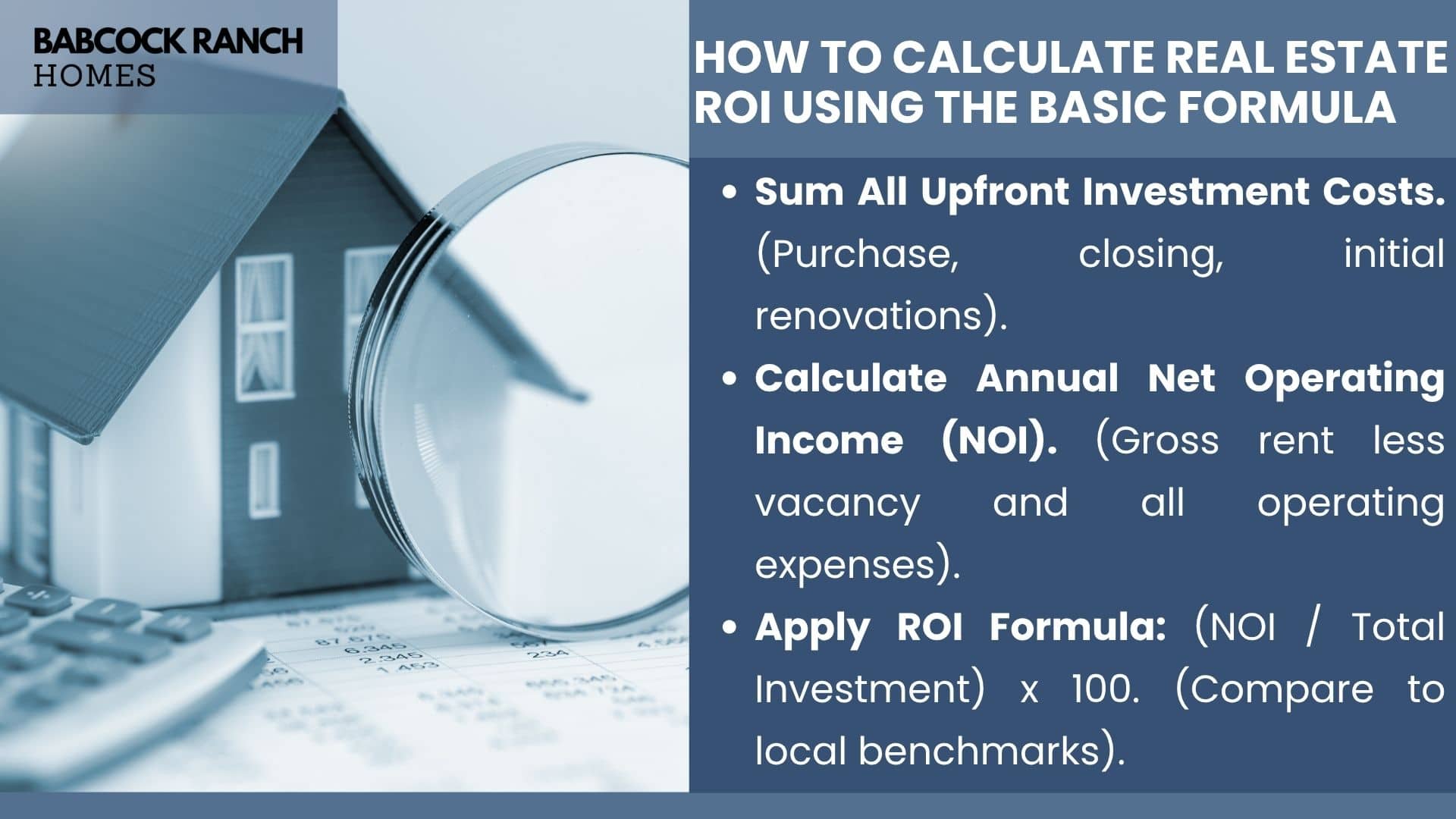

How to Calculate Real Estate ROI Using the Basic Formula

Understanding the basic real estate ROI formula helps investors see a property’s profit chances. This three-step method works for both cash and financed deals, with slight differences. We’ll use Southwest Florida examples to show how location affects results.

Step 1: Determine Total Investment Costs

Your first costs are key for accurate ROI. In places like Babcock Ranch, think about:

Purchase Price and Closing Costs

Start with the sale price and add title fees, appraisal costs, and transfer taxes. Florida’s closing costs usually range from 2-5% of the purchase price.

Renovation and Immediate Repairs

Plan for essential upgrades before renting. A Babcock Ranch home might need $8,000-$12,000 for hurricane-resistant windows or energy-efficient appliances.

Step 2: Calculate Annual Net Operating Income

Find your true cash flow by subtracting costs from rental income:

Gross Rental Income Calculation

Multiply monthly rent by 12, then adjust for local vacancy rates. Southwest Florida’s seasonal market has 8-10% annual vacancy periods.

Subtracting Vacancy Rates and Expenses

- Property taxes (Lee County average: 1.1% of home value)

- Insurance ($1,200-$2,500 annually for coastal properties)

- Maintenance (Budget 1% of property value yearly)

Step 3: Apply the ROI Formula

(Annual Profit / Total Investment) x 100

For a $300,000 Babcock Ranch property with $45,000 initial costs and $18,000 annual profit:

($18,000 / $345,000) x 100 = 5.2% ROI

Interpreting Percentage Results

Compare your result to Southwest Florida’s average 4-6% ROI for single-family rentals. Values above 7% show great opportunities in this market.

While this basic calculator works for quick checks, remember financed deals need extra factors like loan fees and interest rates. Many Babcock Ranch investors use a mix of this formula and cash-on-cash returns for better precision.

Advanced ROI Calculation Methods

To really get a property’s worth, experts say to mix different financial checks. Basic ROI gives a first look, but deeper metrics uncover more. These are key in places like Southwest Florida, where special features like community perks and green tech affect future earnings.

Cash-on-Cash Return Analysis

This method looks at the cash you get back versus what you put in. It’s found by dividing your yearly cash flow by your initial investment. For instance:

- $18,000 annual cash flow ÷ $150,000 down payment = 12% return

In Babcock Ranch, you might see better cash returns because of its low vacancy rates. Plus, its green buildings save on bills, which helps your bottom line.

Capitalization Rate Comparison

Cap rate shows a property’s return without thinking about loans. It’s (Net Operating Income ÷ Property Value) × 100. Here are some Southwest Florida examples:

- Urban Fort Myers: 5.8% average cap rate

- Babcock Ranch: 6.4% average cap rate

Babcock Ranch’s higher cap rate shows its growing appeal and top-notch features. But, cap rates ignore loan costs, making them good for comparing cash deals.

Internal Rate of Return Projections

IRR shows an investment’s yearly growth, including cash flow and value increase. It’s best for:

- Long-term investments

- Properties with changing income

- Investments with many income sources

Babcock Ranch’s growth plans make IRR predictions more solid than in older areas. A 2024 study found IRRs of 9-11% for homes near new community features.

Babcock Ranch Specific ROI Considerations

Babcock Ranch is a special investment in Southwest Florida. It combines green living with smart community design. Investors need to look at four main points to understand its financial value.

Local Market Trends in Southwest Florida

The real estate in Southwest Florida is growing at 4.2% each year. Babcock Ranch is doing even better. The reasons include:

- More people moving in: Lee County’s population has gone up by 12%.

- Not enough homes: There’s only 2.3 months’ worth of single-family homes.

- High demand for rentals: Eco-friendly homes are almost always full.

Community Amenities Impacting Property Values

Babcock Ranch has lots of parks and trails. This makes homes near the downtown Square more valuable. The area’s K-8 solar school and future medical campus also attract families.

Sustainable Features Affecting Operating Costs

The community’s solar power cuts down on energy bills by 30-40%. This is thanks to:

- Smart home tech in new homes.

- Less water needed for landscaping.

- Garages ready for electric cars.

Growth Projections for Babcock Ranch

With 4,200 homes and 11,000 more planned, Babcock Ranch will grow by 200% by 2030. New businesses and waterfront shops will keep the area growing. For a detailed look at investing, call our team at 518-569-7173.

Common ROI Calculation Mistakes to Avoid

Even seasoned investors can mess up their real estate returns with simple math mistakes. These four errors often skew profit forecasts, which is critical in places like Babcock Ranch with its unique costs.

Underestimating Maintenance Costs

The 50% rule is a good starting point: Half of rental income usually covers upkeep, repairs, and empty units. But Florida’s weather means extra money for:

- Hurricane shutter upkeep

- Pool service costs

- Keeping up the landscaping in HOA areas

An investor in Babcock Ranch found out the hard way with a 18% hit on profits from irrigation repairs. Always pad your maintenance estimates by 10-15%.

Overlooking Vacancy Rates

Southwest Florida’s changing population affects rental vacancies. Here are 2023 numbers to keep in mind:

- 7.2% annual vacancy rate for single-family homes

- 22% longer vacancies in summer

- $2,100 average cost to switch tenants

Wise investors use actual days occupied, not just 12 months, to calculate ROI.

Ignoring Property Management Fees

Self-management might seem cheap, but hiring pros can save you money. They help keep tenants, reduce legal issues, and manage upkeep better.

In Babcock Ranch, most investors pay 8-10% monthly for full-service management. This fee affects your net earnings.

Failing to Account for Tax Implications

Florida might not tax income, but property taxes are another story. Think about these:

- Annual property taxes averaging 0.83% of home value

- Federal rules on depreciation recapture

- Costs of 1031 exchanges

One investor almost missed $6,200 in transfer taxes when selling in Babcock Ranch. That’s a 3% hit on ROI.

Babcock Ranch Homes Investment Success Story

Real estate investors often ask how theoretical ROI calculations work in real life. Let’s look at a case study. It shows how smart planning and Babcock Ranch’s special features led to great returns for one owner.

Client Purchase Scenario Overview

In early 2020, an investor bought a 3-bedroom solar home in Babcock Ranch before it was built. Here are the details:

- Purchase price: $325,000 (15% below post-construction value)

- 20% down payment ($65,000)

- 30-year fixed mortgage at 3.25% interest

Detailed Cost and Income Analysis

The investor used a property ROI calculator to figure out costs and income:

- Initial costs: $75,200 (down payment + closing costs)

- Annual expenses: $18,400 (mortgage, taxes, insurance)

- Energy savings: $2,100/year from solar panels and smart home features

- Rental income: $3,200/month ($38,400 annual)

Actual ROI Results Over 3-Year Period

By 2023, the investment showed strong results:

- Annual cash flow: $17,900 ($38,400 income – $20,500 expenses)

- Property appreciation: 22% ($71,500 gain)

- Total ROI: 118% ($89,400 returns ÷ $75,200 investment)

Lessons Learned From Local Investment

This case teaches three important lessons for Southwest Florida investors:

- Buying before construction starts can lower costs

- Sustainable features save money over time

- Community growth can increase property value

The investor’s property ROI calculator was too cautious. Babcock Ranch’s market is growing fast.

Next Steps for Smart Real Estate Investing

Now that you know how to calculate ROI, it’s time to take action. Successful investors use financial formulas and strategic planning. Here’s how to get ready for success.

Expert Guidance Saves Time and Money

Working with experts like Babcock Ranch Homes’ advisors (518-569-7173) offers big benefits:

- They know the local market well, including occupancy rates and price trends.

- They can compare different property types for you.

- They’ll show you tax benefits for Florida investments.

Their team makes complex data easy to understand. This is great for new investors in Southwest Florida’s busy market.

Master Market Intelligence Tools

Real estate investing today needs both digital tools and local knowledge. Start with:

- Babcock Ranch’s quarterly reports on property values.

- FDIC-insured calculators for financing.

- Maps showing when new amenities will be built.

These tools help predict how new amenities will increase property values.

Build Your 10-Year Roadmap

Good long-term planning balances today’s gains with tomorrow’s possibilities. Think about these strategies:

- Save 15% of rental income for maintenance.

- Get professional property checks every 24 months.

- Use software to track your investment’s growth.

Pro Tip: Dashboards show how small gains add up over time.

Are you ready to begin? Call 518-569-7173 for a consultation. Get customized reports and financing options. With the right tools and partners, you’ll see your ROI efforts pay off.

Conclusion

Learning how to calculate real estate ROI turns guesses into smart choices. This skill lets investors look at Southwest Florida properties clearly. It balances the costs now with the benefits later.

In places like Babcock Ranch, this skill is even more important. Here, green design and growth plans add special value.

Getting ROI right means watching both fixed costs and changing market factors. For example, Babcock Ranch’s solar power lowers costs. At the same time, its growth affects how much properties are worth.

Babcock Ranch Homes helps investors make smart choices. They teach about net operating income and capital rates. This helps investors make confident decisions.

Investors can start making plans with help from Babcock Ranch Homes. They offer reports on prices, rentals, and when new projects will start. This helps investors understand the local market better.

Knowing how to calculate ROI is key to building wealth through property. With the right advice, investors can handle market changes well. They can find good chances for growth in Southwest Florida’s lively areas.