Understanding the relationship between borrowing costs and property trends is critical for buyers and investors. Recent data from Freddie Mac shows existing home sales rose in February, but elevated financing costs continue to challenge market momentum. These conditions create a unique environment where timing and local expertise matter.

Mortgage rates directly influence purchasing power and affordability. When financing costs rise, monthly payments increase, which can slow buyer activity. Conversely, lower rates often boost demand. Right now, the Federal Reserve’s policies have kept borrowing expenses higher than pre-pandemic levels, reshaping priorities for those entering the market.

Nationwide trends like limited housing inventory add another layer of complexity. With fewer available homes, competition remains steady even as costs fluctuate. This dynamic impacts pricing strategies and negotiation timelines, particularly in growing communities like Babcock Ranch, Florida.

For those navigating these shifts, partnering with experienced professionals is key. Babcock Ranch Homes offers tailored guidance to help buyers and investors adapt to evolving conditions. Reach out at 518-569-7173 for insights tailored to Southwest Florida’s unique opportunities.

Key Takeaways

- Mortgage rates impact affordability and buyer decisions.

- Federal Reserve policies influence current borrowing costs.

- Low housing inventory sustains competition despite rate changes.

- Local market expertise helps navigate pricing and demand shifts.

- Babcock Ranch Homes provides actionable insights for Florida buyers.

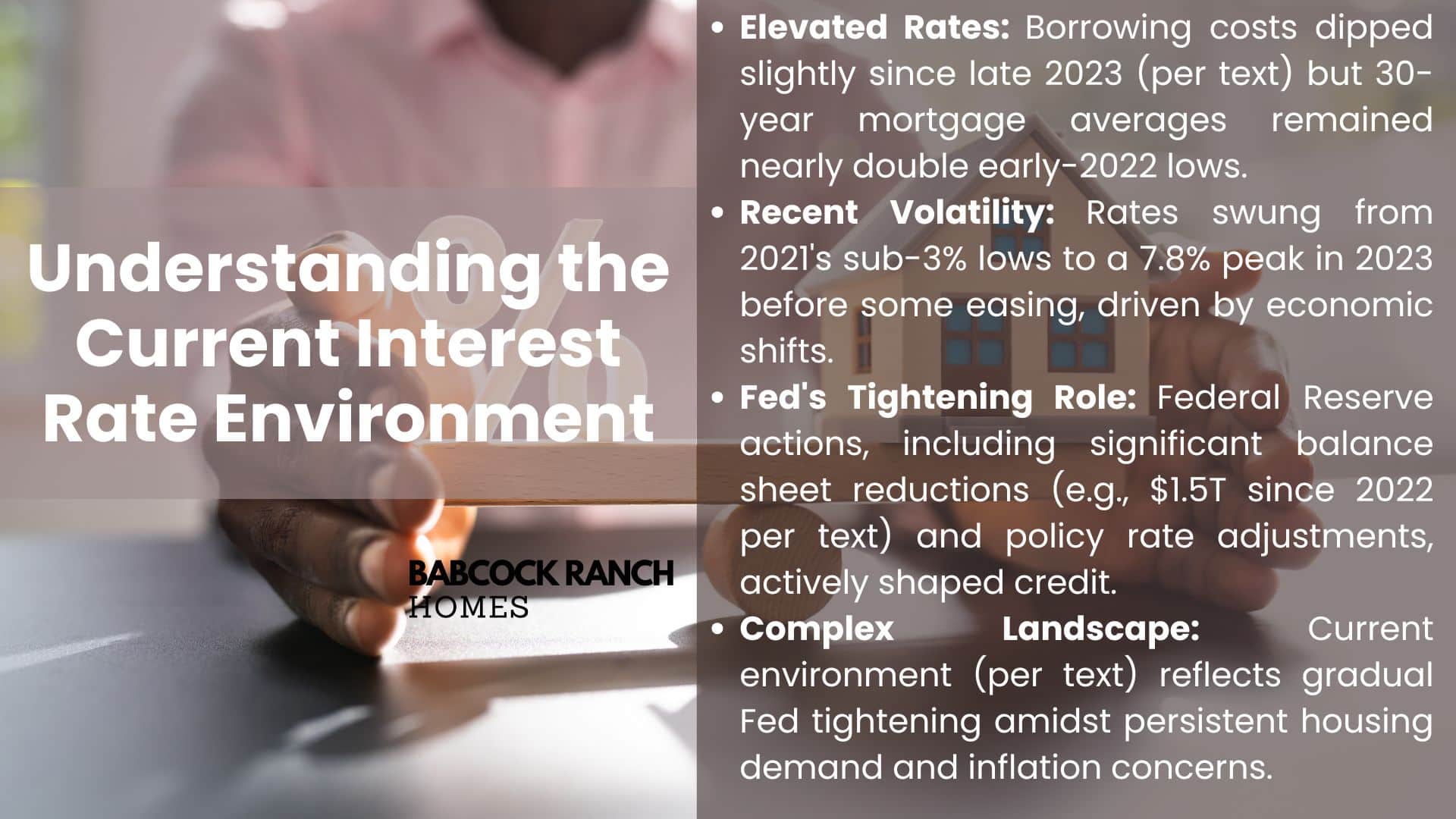

Understanding the Current Interest Rate Environment

Multiple factors shape today’s financial landscape for property transactions. While borrowing costs have dipped slightly since late 2023, 30-year mortgage averages remain nearly double their early-2022 levels. This shift creates distinct challenges for buyers balancing budgets with long-term goals.

Historical Trends and Economic Context

Over the past decade, mortgage averages have swung dramatically:

- 2019: 3.9% average for 30-year loans

- 2021: Record lows below 3%

- 2023: Peaked at 7.8% before easing

These fluctuations stem from pandemic recovery efforts, inflation spikes, and global supply chain disruptions. Unlike previous cycles, today’s rate environment combines gradual Fed tightening with persistent housing demand.

Recent Data and Federal Reserve Actions

The Federal Reserve has actively shaped credit conditions through:

- Balance sheet reductions totaling $1.5 trillion since 2022

- Ongoing adjustments to short-term policy rates

- Strategic sales of mortgage-backed securities

As Fed Chair Jerome Powell noted, “Our focus remains on achieving maximum employment while stabilizing prices.” These measures aim to cool inflation without derailing economic growth, creating a delicate balance for housing markets.

In Southwest Florida, Babcock Ranch Homes helps clients navigate these national trends through hyperlocal insights. Their team analyzes how macroeconomic shifts influence neighborhood-specific pricing and availability patterns.

How Interest Rates Affect Real Estate Markets

Recent shifts in borrowing costs are reshaping property dynamics across the U.S. Existing home sales climbed 4.2% in February 2025, yet overall activity stays below historical averages. Limited inventory and seasonal weather patterns continue to challenge market momentum.

Impact on Home Sales, Prices, and Inventory Levels

Higher financing expenses create ripple effects:

- Slower transaction pace as buyers weigh increased monthly obligations

- Price stabilization in markets with balanced supply-demand ratios

- Inventory stagnation as homeowners delay selling to retain lower-rate mortgages

In communities like Babcock Ranch, Florida, limited availability keeps competition steady even as national trends fluctuate. Local experts note properties priced correctly still attract multiple offers within days.

Mortgage Affordability and Buyer Behavior

When loan costs rise, purchasing power shrinks. A 1% rate increase can reduce budget capacity by 10-15%, forcing adjustments in home size or location preferences. First-time purchasers often face the toughest hurdles.

Key factors influencing decisions:

- Down payment requirements

- Debt-to-income ratios

- Credit score thresholds

“Many clients now prioritize adjustable-rate loans or shorter-term financing,” shares a Babcock Ranch Homes advisor. This strategic approach helps manage payment expectations while building equity.

Analyzing Market Trends and Investor Behavior

Investors are recalibrating strategies as financial conditions evolve. While rising capital costs challenge traditional approaches, opportunities emerge for those adapting to new patterns. Real estate investment trusts (REITs) saw a 12% uptick in institutional participation last quarter, signaling renewed confidence in income-generating assets.

Investor Demand and REIT Performance

Market volatility has reshaped priorities for capital allocation. REITs focusing on residential and industrial properties outperformed retail-focused trusts by 18% in Q1 2025. Key drivers include:

- Strong rental demand in Sun Belt markets

- E-commerce-driven warehouse space needs

- Hybrid work models boosting suburban housing

“Diversification across sectors mitigates risk when rates shift,” notes a Babcock Ranch Homes analyst. Their team helps clients identify properties aligning with these trends.

Strategies for Portfolio Diversification

Balancing risk requires mixing asset types and locations. Successful investors often combine:

- Core holdings in stable markets

- Value-add opportunities with renovation potential

- Geographic spreads across growth regions

Southwest Florida’s market demonstrates resilience, with single-family home values rising 6.3% year-over-year despite broader fluctuations. Babcock Ranch Homes provides localized data to help structure portfolios that withstand economic shifts.

Insight from Housing Market Data and Reports

Recent housing reports reveal critical patterns influencing buyer decisions and market stability. Analysis shows inventory levels remain 34% below pre-pandemic averages despite a 5.7% national sales increase last quarter. This imbalance creates unique pressure points across demographics.

Existing Home Sales and Housing Starts Analysis

Freddie Mac data highlights contrasting trends in residential activity:

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Existing Home Sales | 4.1M | 4.3M | +4.9% |

| New Housing Starts | 1.42M | 1.38M | -2.8% |

| Median Days on Market | 32 | 27 | -15.6% |

Builders face rising construction costs, slowing new development despite buyer demand. Southwest Florida markets like Babcock Ranch buck this trend with 12% annual housing start growth.

Trends in Home Price Fluctuations and Demand

Price growth varies significantly by region and property type. Luxury homes above $750k saw values rise 8.2% year-over-year, while entry-level properties increased just 3.1%. Payment expectations now consume 25% of median household income nationally.

Three key risk factors emerge from recent data:

- Inventory shortages in 78% of metro areas

- Mortgage yields nearing 6.5% for 30-year loans

- Economic uncertainty delaying 29% of first-time buyers

“Localized strategies outperform generic approaches in today’s market,” notes a Babcock Ranch Homes analyst. Their team uses hyperlocal data to identify neighborhoods balancing affordability with appreciation potential.

The Federal Reserve’s Role in Shaping Mortgage Rates

The Federal Reserve’s monetary policies act as a steering wheel for national credit conditions. When central bankers adjust their approach, it creates waves across treasury markets and lending practices. These changes ultimately determine what borrowers pay for home loans.

Effects of Fed Rate Decisions on Mortgage Rates

While the Fed doesn’t set mortgage rates directly, its actions influence treasury yields – the foundation for long-term borrowing costs. When the central bank holds benchmark rates steady, as it did in June 2024, lenders adjust their risk premiums. This creates a “wait-and-see” environment for refinancing activity.

| Period | 10-Year Treasury Yield | 30-Year Mortgage Rate |

|---|---|---|

| Q1 2023 | 3.4% | 6.2% |

| Q4 2024 | 4.1% | 7.0% |

| Projected 2025 | 3.8% | 6.5% |

The spread between treasury bonds and home loans widened to 290 basis points in 2024 – nearly double pre-pandemic levels. This gap reflects lenders’ caution in uncertain economic times.

Loan Environment and Credit Market Implications

Tighter monetary policy reshapes lending strategies across the board. Banks now prioritize quality over quantity in their mortgage portfolios. “We’re seeing stricter debt-to-income ratios,” notes a Florida-based loan officer. “It’s about sustainable investments, not just volume.”

Three key trends define today’s credit environment:

- Refinancing windows narrowing as rate volatility increases

- Portfolio diversification becoming essential for risk management

- Strategic pauses in construction lending until financing costs stabilize

Over time, these shifts may increase borrowing costs for commercial projects and second homes. Savvy investors monitor Fed announcements closely, adjusting their strategies weeks before policy changes take effect.

Planning Your Real Estate Investment Strategy

Building a resilient property portfolio requires adapting to financial shifts while maintaining long-term goals. With market conditions evolving rapidly, proactive investors balance immediate opportunities with strategies that withstand economic cycles. Babcock Ranch Homes emphasizes three pillars: equity growth, policy awareness, and strategic timing.

Tips for Borrowers in a Changing Rate Environment

Locking in favorable terms demands vigilance. Compare multiple lenders over months to identify competitive offers. For example, a 0.5% rate difference on a $400,000 loan saves $120 monthly. “Flexibility separates successful investors from reactive ones,” notes a Southwest Florida advisor.

Prioritize loans with prepayment options to accelerate equity gains. Consider these steps:

- Review credit reports biannually to maintain high approval odds

- Opt for adjustable-rate mortgages if planning to sell within 5 years

- Allocate 15-20% of rental income to principal reductions

Considerations for Refinancing and Future Investments

Refinancing becomes viable when rates drop 1% below current loans. However, closing costs and break-even timelines (typically 24-36 months) require careful math. Investors often use cash-out refinancing to fund renovations that boost property values.

Key policy indicators to monitor:

- Federal Reserve meeting schedules

- Local zoning regulation updates

- State tax incentive programs

Diversify holdings across price levels to mitigate risk. Entry-level homes provide steady cash flow, while luxury properties offer appreciation potential. Babcock Ranch Homes tailors strategies using hyperlocal data, helping clients navigate Southwest Florida’s unique challenges and opportunities.

Conclusion

Navigating today’s dynamic property landscape requires both insight and adaptability. Federal Reserve decisions and housing inventory trends continue steering financial conditions, making expert guidance essential for informed choices. Recent data shows credit availability remains tight, while localized opportunities emerge in resilient markets like Southwest Florida.

Babcock Ranch Homes helps clients interpret these patterns through a dual lens: national economic shifts and neighborhood-specific dynamics. Their team translates complex indicators into actionable strategies, whether you’re securing financing or evaluating appreciation potential.

Three priorities stand out today:

- Monitoring Fed policy impacts on loan terms

- Balancing credit requirements with long-term goals

- Acting quickly when market windows open

For personalized assistance aligning your plans with today’s conditions, contact Babcock Ranch Homes at 518-569-7173. Their advisors provide clarity amid evolving trends, helping turn challenges into strategic advantages.